Payconiq Merchant API Guide

The Payconiq Developer Guide serves as the primary technical reference document for merchants, partners and other stakeholders using the Integration APIs to accept Payments via the Payconiq platform.

Why Payconiq

Your customers do everything with their phone: look up prices, request routes to the store, compare articles. But paying with a telephone still sounds like music for the future. Just like when contactless payment was introduced a few years ago. The future is reality faster than you think. Thanks to Payconiq you can now let your customers experience the convenience of mobile payment. It is simple, fast and secure. Pay instore, online and your invoice with just your mobile phone.

This video provides more information about What Payconiq is.

For more information on the Payconiq privacy & cookies statement please click here.

Payconiq Product Overview

Payconiq offers the following products in the world of mobile payment.

Payconiq Instore

Payconiq can be directly integrated into your cash register system or pin terminal. You show a QR code in your store on a receipt, sticker (at the cash register), customer-facing screen or pin terminal. Your customer will then scan the QR code with the app on his phone. Just confirm and get paid.

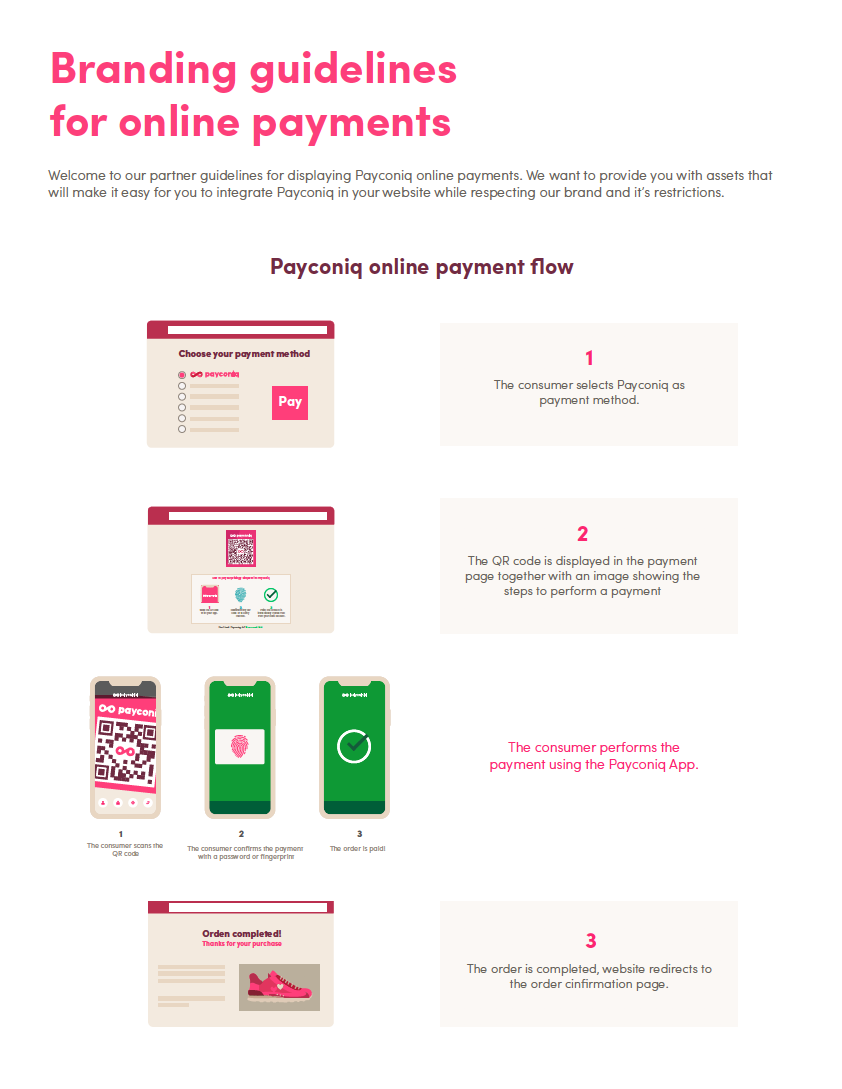

Payconiq Online

Payconiq can be directly integrated into your webshop. To complete an online order, a unique QR code appears on the screen. Your customer scans it with the Payconiq-supported app and pays without having to leave your page. On mobile, it will create an app2app payment via a universal deep link.

Payconiq Invoice

Invoices paid via mobile phone are paid thrice as fast compared to normal payments and without the hassle of typing over the invoice data. Payconiq can be Payconiq can be directly integrated with your invoices and allows your customers to pay it with their mobile phone.

Latest Payconiq Version

- The current version of the Payconiq APIs is V3.

Getting Started

In order to get started, the following activities and necessary access will be arranged.

Merchant Onboarding

This is the process of setting up merchants on the Payconiq platform in order to interact with the API endpoints. As part of the onboarding process, you will receive a generated unique Merchant Identifier and an API key which will be used when interacting with the Payconiq endpoints. This will be shared via mail.

Environments

There are two environments where merchants and partners are exposed to. The External Environment (EXT) and the Production Environment (PROD).

External Environment

This is a pre-production environment where all tests and integration work are carried out. We recommend a sign off is granted on this environment before moving to the production environment. All tests performed with the test accounts never hit the production or real banking environment.

You can also email us at [email protected] to get external account access.

In case you don’t have an external account yet, please provide the following information to [email protected]:

- Company Name

- Contact First Name

- Contact Second Name

- Callback URL

- Type of Integration: Instore on display, Custom Online, app2app, POS etc. Please mention the Payconiq product for which you need a test merchant account here. Payconiq products available at: Payconiq-Developer Portal

Production Environment

This is the environment where real transactions take place. Once onboarded and transactions take place, please note that app user accounts will be debited, and merchant accounts will be credited.

Merchant Portal

Once the merchant has been onboarded, the merchant is able to view all transactions on the Payconiq merchant portal with the following URLs.

EXT Merchant Portal: https://portal.ext.payconiq.com/login

PROD Merchant Portal: https://portal.payconiq.com/login

Note: It might be that access to the merchant portal on EXT is blocked for security reasons. This is because Payconiq is not active in the country from which the merchant is requesting access. A VPN connection may be setup to be able to access the EXT merchant portal.

Payconiq Apps for Testing

Once integration is completed, you can test with the External build of Payconiq Test app (for hyperlink https://ext.payconiq.com/test-app-pwa/login)

The app can be accessed both via mobile and desktop with a camera. Testing steps:

Go to https://ext.payconiq.com/test-app-pwa/login and login using your payment profileID and API key that you received via email for EXT environment. Payment profile ID is also visible in your Merchant Portal account.

Give access to your camera.

Generate a QR code for the product you would like to test via Merchant Portal and scan it with the web test app. The amount should be between 0.01 EUR to 100 EUR.

After completing the payment, you can search for the paymentID in the Merchant Portal to verify a successful payment.

To test an unhappy scenario when the payment fails on the bank side, you can test with the amount above 100 EUR.

The Payconiq Brand Guide

Online Payments

You can find Payconiq's Branding Guidelines for Online Payments here.

The Payconiq QR Code

The Payconiq QR code is branded with our mark. The branding gives trust and makes it easy for our users to see where they can pay with Payconiq. Instead of black we use our darkest shade of magenta for the QR-code to match our primary colour but still keeping the contrast.

The Payconiq QR code can be rendered in a web view container for quick scanning. A link is returned anytime a payment is created and can be easily rendered in a web view. This url makes use of Payconiq’s QR code generation service. By default, the Payconiq QR code is returned as a PNG with a small (S) size.

Sample Magenta & White Payconiq QR Code

Sample Black & White Payconiq QR Code

Payconiq QR Code Sizes and Scan Distances.

- Payconiq recommends the following Payconiq QR Code sizes and scanning distances when displaying the Payconiq QR Code.

- Take note of the scanning distance in order to use the correct Payconiq QR Code size.

| Recommend Size | Pixels | Scanning Distance |

|---|---|---|

| Small (S) | 180x180 pixels | 15 cm |

| Medium (M) | 250x250 pixels | 20 cm |

| Large (L) | 400x400 pixels | 30 cm |

| Extra Large (XL) | 800x800 pixels | 40 cm |

Payconiq QR Code Colours

- The Payconiq QR code comes in two flavours. Magenta and white or Black and white.

The Payconiq Frames

Payconiq provides a branding frame consisting of a magenta border and a Payconiq logo. The Payconiq QR code should be embedded in this frame and presented to the customer when scanning a Payconiq QR code on terminal and consumer facing displays.

The frames are in both PNG and SVG formats.

An example frame before QR code is overlaid for consumer scanning.

Below is an example of the final implementation of the Payconiq QR code and Payconiq frame there is a 10% border around the QR code (bottom and sides).

Below are the frame formats that are available.

| Description | Format |

|---|---|

| Frame - Small | PNG |

| Frame - Medium | PNG |

| Frame - Large | PNG |

| Frame - Extra Large | PNG |

| Frame - Small | SVG |

| Frame - Medium | SVG |

| Frame - Large | SVG |

| Frame - Extra Large | SVG |

The Payconiq Pay Button

There are two ways to display a Payconiq payment button on a payment/check-out page for an online payment.

1. Preferably, the complete logo.

Minimum height: 20 pixels (40 retina pixels)

Minimum width: 120 pixels (242 retina pixels)

Minimum height: 4 mm

| Description | Image Format |

|---|---|

| Payconiq Logo 363 x 60 pixels | PNG |

| Payconiq Logo 242 x 40 pixels | PNG |

| Payconiq Logo 182 x 30 pixels | PNG |

| Payconiq Logo 120 x 20 pixels | PNG |

| Payconiq Logo | SVG |

2. If you have limited space available for the payment button, you can show only the Payconiq mark. Make sure to add the word 'Payconiq' next to it then.

Below is an example of how it is used.

Minimum height: 14 pixels (40 retina pixels)

Minimum width: 31 pixels (242 retina pixels)

Minimum height: 3 mm

| Description | Image Format |

|---|---|

| Payconiq Mark 93 x 42 pixels | PNG |

| Payconiq Mark 62 x 28 pixels | PNG |

| Payconiq Mark 47 x 21 pixels | PNG |

| Payconiq Mark 31 x 14 pixels | PNG |

| Payconiq Mark | SVG |

You can request a white Payconiq logo for pages with backgrounds in dark colours via [email protected].

Note:

- If the resolution is lower than the screen resolution please use the SVG instead of the PNG to keep a sharp image.

- In case any of these sizes are not compatible with your setup please get in touch via [email protected] for further assistance.

Payouts

For all Payconiq payments that are made to our merchant, Payconiq ensures that that funds are credited to your bank account by means of a credit transfer. The credit transfer for payments to your account can be received in two ways.

Bulk Payouts - All payments to your merchant for a day are credited as one single line item on your bank account.

Individual Payouts - All payments to your merchant are credited as multiple line items on your bank account.

By default your merchant is configured to have Individual Payouts. If you would like to receive Bulk Payouts for payments to your merchant, please reach out to Buckaroo at [email protected].

Bulk Payouts and Remittance

Bulking of payments refers to the process of aggregating individual consumer payments in batches. In order to have your successful transactions bulked, the bulking service has to be enabled for your merchant. Bulking feature is provided through Buckaroo. Please send an email to [email protected] in order to have the feature enabled.

The bulking of transactions is based on your bank account and Merchant Id. With this method all payments are aggregated based on your bank account number (IBAN) and Merchant Id.

Bulking Notes

- Successful Transactions are bulked over the course of a day from 00:01:00 to 00:00:00 (CET) next day.

- After the transactions have been aggregated, there is a payout from Buckaroo to your bank account the working day after. For transactions done on Friday, Saturday and Sunday payout will be done from Buckaroo end but it depends on the merchant's bank if they do a payout towards merchant's account on Saturday and Sunday or not.

- Your account will be credited either two to three days after the transactions are bulked.

- The remittance information contains the date the payments were processed YYYYMMDD (8 char) + Payout end2end ID (24 char) + bulk ID (35 char) + PQ (2 char) + BulkRecon (9 char) + Merchant ID (24 char).

- Each item in the remittance information is separated by hyphens: “-”

- The bulk end to end identifier will also be in the End-to-end reference field of your bank statement.

- Reconciliation can be done via My.Buckaroo Portal.

Individual Payouts and Remittance

Buckaroo pays out all payments received to the IBAN specified during the onboarding process. These payouts are always via SEPA Credit transfers and are comprised of only consumer payments.

Remittance Information

A successful Payment results in a credit transfer from the consumer’s (payer) payment account (held with the consumer’s bank) to the Merchant's/Partner's payment bank account. There is 1 exemption to this:

If the Merchant/Partner makes use of the Buckaroo Bulking Service, then Buckaroo will credit Merchant's/Partner’s payment account via aggregated amounts in a batched fashion in an agreed timetable.

Bank Statement Description

When a Payment reaches the final status “SUCCEEDED”, the Buckaroo backend initiates a credit transfer from the consumer’s payment account to the Merchant's/Partner’s payment account or Payconiq's payment account. The remittance information provided with the credit transfer has a maximum length of 140 characters (as standardized by the European Payments Council / EPC). These 140 characters will be encoded per default as concatenated string values, separated by spaces, in accordance with the table below. Banks provide this remittance information in online banking environments and/or paper bank statements.

Sample Remittance Information

"Payconiq f60454fd52e429d71964745d Online Kassa 4zyeYIKOw54Ybc9yenL5 Mars Bars "

| Field Name | Description | Format |

|---|---|---|

Issuer |

The entity that facilitates Payconiq Payment | String [Max Length: 8] |

Delimiter |

Field separator | String: Space [Max Length: 1] |

Payment Identifier |

A unique identifier representing a Payconiq Payment Transaction | String: Space [Max Length: 24] |

Delimiter |

Field separator | String: Space [Max Length: 1] |

Merchant Name |

The name of the merchant where the Payconiq Payment Transaction takes place. Field is padded with spaces if the max length is not reached | String [Max Length: 23] |

Delimiter |

Field separator | String: Space [Max Length: 1] |

Reference |

A unique identifier referencing a Payconiq Payment Transaction in the Partner's system. Field is padded with spaces if the max length is not reached. | String [Max Length: 35] |

Delimiter |

Field separator | String: Space [Max Length: 1] |

Description |

A description linked to a Payconiq Payment Transaction. Field is padded with spaces if the max length is not reached. | String [Max Length: 46] |

An example of the remittance information entry is as follows for the sample values provided in the table above.

“Payconiq f60454fd52e429d71964745d Online Kassa 4zyeYIKOw54Ybc9yenL5 Mars Bars ”

Note: The above does not apply to the bulked Payconiq Payments.

Payment API Version 3 (V3)

The Payconiq API is organized around REST and uses HTTP response codes to indicate API errors. In addition, standard HTTP features such as header authentication and HTTP verbs which are understood by off the shelf HTTP clients across all the programming languages are also used. JSON bodies are used in requests and returned in relevant API responses, including errors.

Authentication

All requests to the Payconiq payment system are authenticated using API keys. API keys grant extensive access rights to the Payconiq payment system therefore ensure they are kept safe. Do not share your API keys in public areas such as online sites or client-side code. The API key is set in the header of the requests via HTTP Authorization header.

All requests are encrypted using TLS 1.2 or TLS 1.3.

All API requests must be made over Https. Any calls made over unencrypted Http will fail. Wrong API keys or API requests without an API keys will also fail.

To receive an API key, a formal request has to be raised with a Payconiq account manager who will ensure that the correct access is provided.

Merchant Callback

Each Merchant or Partner may define a specific asynchronous HTTPS confirm URL (callback URL) via which Payconiq will notify the status of a payment. This allows the merchant’s or partner’s backend to react to the payment and process the data (mark the payment in database, update the product count number, send an email to the consumer, etc). The callbacks are asynchronous. The callbacks are issued via HTTP POST requests and encrypted using TLS 1.2.

You may choose to receive the payment callbacks either via one-way or two-way(requires enablement on server side) TLS encryption.

TLS One-way TLS Encryption Support

In the TLS One-way encyrption, all callback requests will be encrypted where the Payconiq backend verifies the certificate of the merchant or partner anytime Payconiq sends a callback request. There is not requirement to exchange certificates beforehand and the callbacks should work out of the boc. Please contact [email protected] if you are having any issues.

TLS Two-way TLS Encryption Support (TLS-Mutual Authentication)

In the two-way TLS encryption support, the merchant or parter verifies the details of Payconiq before processing the details of the callback. This allows Payconiq and the merchant or partner to communicate with privacy and data integrity with an additional JWS security. Please reach out to [email protected] regarding necessary certificate details that need to be shared if this is required.

TLS-MA Certificate Rotation & Pinning

Payconiq reserves the right to rotate its certificate without informing the merchant or partner since each certificate has a validity period or may be compromised. In case the merchant or partner pins certificates, it must only pin the Payconiq certificate on the CN name. This will make rotation of the certificate seamless.

Callback Retry Policy

Payconiq guarantees sending a callback to the backend of a merchant or partner for 24 hours. In the event the merchant or parter does not respond correctly (Http 200 - OK) to the initial callback, Payconiq retries delivering the callback. After 24 hours, Payconiq stops trying to resend the callback.

Payconiq retries to send a callback for the following scenarios:

- Not responding in 15 seconds to the callback

- Responding with a Http 429 - Too Many Requests

- Responding with a Http 500 - Internal Server Error

- Responding with a Http 503 - Service Unavailable

- Responding with a Http 504 - Gateway Timeout

- Responding with a Http 509 - Bandwidth Limit Exceeded

Notes

- The status of a payment does not change.

- The content of callback does not change. The headers, body and target url remains as just as the first attempt.

- Responding with a Http 200 means that Payconiq stops sending the callback.

- After 24 hours Payconiq stops retrying the callback.

Callback Headers

The callback consists of headers of which some are informational and others used to verify the signature of the callback. The parameters in the header are made up of the following:

signature: eyJ0eXAiOiJKT1NFK0pTT04iLCJraWQiOiJ5ZXNPbmUiLCJhbGciOiJSUzI1NiIsImh0dHBzOi8vcGF5Y29uaXEuY29tL2lhdCI6IjIwMTktMDEtMTRUMTE6MTE6MTFaIiwiaHR0cHM6Ly9wYXljb25pcS5jb20vanRpIjoiR2l2ZU1lIiwiaHR0cHM6Ly9wYXljb25pcS5jb20vcGF0aCI6Ii90aGUvcm9hZC9sZXNzL3RyYXZlbGVkIiwiaHR0cHM6Ly9wYXljb25pcS5jb20vaXNzIjoiUGF5Y29uaXEiLCJjcml0IjpbImh0dHBzOi8vcGF5Y29uaXEuY29tL2lhdCIsImh0dHBzOi8vcGF5Y29uaXEuY29tL2p0aSIsImh0dHBzOi8vcGF5Y29uaXEuY29tL3BhdGgiLCJodHRwczovL3BheWNvbmlxLmNvbS9pc3MiXX0..LoBPG9T00c-0urv5FXrTWmumUJBTpTaqG5F0HciYHgi0Ck-bZrFxX8MLEgKbdv5YUMKKDnbLcFS0M4lNiGa17Qo8OOH4mCAjvuVEyoutHObd_TrZ4oUM0CX3uRNd88shemup9YPEMtRjmPZATXzStTBdQeRpq_f89bAqy2nCOxg_2BgqSnvC_R4JMA7I5SaRndvzbn80oeVHUEMkpmRFNnhRtVujeEUnfn3hBR_YIHh3vJKWArIYOV9eMkpDFb6nC_GoZoNGfPFunBUtOXU1y3gCDi6GOsa4eaDygNsBk-ZNj2v8cMRPBnHdw2oOaAjEs6K63An0bbkdKG7UzVojAw

content-type: application/json

user-agent: Payconiq Payments/v3

json

{

"paymentId": "5ba37c3d0989e3000758b9d8",

"transferAmount": 122,

"tippingAmount": 0,

"amount": 122,

"totalAmount": 122,

"description": "Sample description",

"createdAt": "2019-11-26T15:26:19.363Z",

"expireAt": "2019-11-26T15:29:19.363Z",

"succeededAt": "2019-11-26T15:27:34.835Z",

"status": "SUCCEEDED",

"debtor": {

"name": "John",

"iban": "*************12636"

},

"currency": "EUR",

"reference": "12346816AFV",

}

| Name | Description |

|---|---|

signature |

This represents a Payconiq digitally signed content using JSON data structures and base64url encoding which makes up the JSON Web Signature (JWS). |

user-agent |

The User-Agent request header contains a characteristic string that allows the network protocol peers to identify the application type, operating system, software vendor or software version of the requesting software user agent. |

content-type |

The Content-Type entity header is used to indicate the media type of the resource. |

Callback Body

The body of the callback is JSON formatted with fields indicating the status of the payment. The values in the body can be used to update the payment in the merchant’s system.

Once the signature has been verified, the values in the body can be used to update the payment in the merchant’s system.

The following parameters are included in the body of the callback request.

| Attribute | Description |

|---|---|

paymentId [String, required] Fixed length: 24 chars |

The unique Payconiq payment id. |

amount [Integer, required] Minimum: 1 Maximum: 999999 |

Payment amount in Euro cents. |

transferAmount [Integer, required] Minimum: 1 Maximum: 999999 |

The amount the consumer will be charged in Euro cents |

tippingAmount [Integer, required] Minimum: 1 Maximum: 999999 |

The amount added as a tip by the consumer in Euro cents (currently not supported). |

totalAmount [Integer, required] Minimum: 1 Maximum: 999999 |

The amount the consumer pays in total in Euro cents. |

currency [String, optional] |

Payment currency code in ISO 4217 format. Only Euros supported at the moment. |

description [String, optional] |

Custom description of the payment. This will be shown to the consumer when making payments and will be present on the bank statement of the merchant and consumer for reconciliation purposes. Only the first 35 characters are used for the remittance information. |

reference [String, optional] |

Merchant’s payment reference used to reference the Payconiq payment in the merchant’s system. |

createdAt [String, required] Format: YYYY-MM-ddTHH:mm:ss.SSSZ |

The creation date and time of the Payconiq payment. |

expireAt [String, required] Format: YYYY-MM-ddTHH:mm:ss.SSSZ |

The date and time when a Payconiq payment expires. |

succeededAt [String, optional] Format: YYYY-MM-ddTHH:mm:ss.SSSZ |

The date and time when a Payconiq payment succeeded. |

status [String::enum, required] Allowed values: PENDING, IDENTIFIED, AUTHORIZED, AUTHORIZATION_FAILED, SUCCEEDED, FAILED, CANCELLED, EXPIRED,PENDING_MERCHANT_ACKNOWLEDGEMENT. |

The status of the Payconiq Payment. |

debtor[JSON Object, required] |

The consumer account object that makes payments to the merchant |

debtor.name [String, optional] |

Debtor's first name. |

debtor.iban [String, optional] |

Debtor's IBAN masked. |

The main statuses that are most important to the implementation are as follows and have been described above. These are returned as the end state of a transaction.

- SUCCEEDED

- FAILED

- EXPIRED

- CANCELLED

- AUTHORIZATION_FAILED

Other status names that can also be returned when the transaction status is obtained are as follows.

- AUTHORIZED

- PENDING

- IDENTIFIED

The Callback Signature

To prove that Payconiq generated the callback to the merchant, the Payconiq API sends a detached JSON Web Signature(JWS) which includes the signed base64UrlEncoded header and request body. The signature is signed using a publicly hosted certificate. A JWS represents these logical values separated by dots(.):

- JOSE Header

- JWS Payload (Not included)

- JWS Signature

The signature will be generated as per following instructions:

jws = base64URLEncode(JOSE Header)..base64URLEncode(alg(base64URLEncode(JOSE Header).base64URLEncode(Request Body)))

Terminologies

| Name | Description |

|---|---|

| JSON Web Signature (JWS) | A data structure representing a digitally signed message. |

| JSON Object Signing and Encryption (JOSE) Header | JSON object containing the parameters describing the cryptographic operations and parameters employed. |

| JSON Web Key (JWK) | A JSON object that represents a cryptographic key. The members of the object represent properties of the key, including its value. |

| JSON Web Key Set (JWKS) | A JSON object that represents a set of JWKs. |

The JOSE Header setup by Payconiq consists of the following:

{

"typ": "jose+json",

"kid": "JWK kid",

"alg": "ES256",

"crit": ["https://payconiq.com/sub", "https://payconiq.com/iss", "https://payconiq.com/iat", "https://payconiq.com/jti", "https://payconiq.com/path"],

"https://payconiq.com/sub" : "{PaymentProfileId}",

"https://payconiq.com/iss" : "Payconiq",

"https://payconiq.com/iat" : "{Current creation date time in [ISODateTime format], expressed in UTC time format(YYYY-MM-DDThh:mm:ss.sssZ)},

"https://payconiq.com/jti" : "{Unique-request-identifier}",

"https://payconiq.com/path": "callback request path ex. https://www.merchantcallback.com/payconiqpayment"

}

JOSE Header Fields

| Header Parameter | Description |

|---|---|

| typ - Type | The "typ" (type) Header Parameter is used by JWS applications to declare the media type [IANA.MediaTypes] of this complete JWS. |

| kid - Key ID | The "kid" (key ID) Header Parameter is a hint indicating which key was used to secure the JWS |

| alg - Algorithm | The "alg" (algorithm) Header Parameter identifies the cryptographic algorithm used to secure the JWS. |

| crit - Critical | The "crit" (critical) Header Parameter indicates that extensions to this specification and/or [JWA] are being used that MUST be understood and processed. |

Verifying the Callback Signature

The merchant or Partner must verify the signature in order to obtain cryptographic proof regarding the integrity and authenticity of the message.

To verify the JWS, refer to the JWS documentation which provides extensive guidelines.

Alternatively, the following steps can be performed to verify the signature. If any of the listed steps fails, then the signature cannot be verified.

Notes

- Prior to verifying the signature, you can cache the full JWKS. This ensures that the JWKS is not always downloaded via the URL to verify the signature.

- To know which JWK to use in verifying the signature, retrieve the JWK whose key id matches with the key id in the JOSE Header of the signature.

- The JWKS can be downloaded and re-cached whenever the key id in the JOSE Header does not match what was previously cached.

- The ES256 signature algorithm is whitelisted. The algorithm of the JWK.

Steps

- This assumes that the JWKS has been cached.

- Extract the "kid" field from the JOSE Header of the signature.

- Compare the extracted "kid" with the cached "kid" in the JWKS. If there is a match, jump to step 3. If they do not match, jump to step 4.

Use the cached JWK to verify the signature using your preferred library (for java the standard is jose4j) making sure that:

->> The following critical headers are set: "https://payconiq.com/iat", "https://payconiq.com/jti", "https://payconiq.com/path", "https://payconiq.com/iss", "https://payconiq.com/sub".

Refresh the JWKS cached by downloading the latest JWKS.

- Extract the "kid" field from the JOSE Header of the signature to retrieve the corresponding JWK.

Used the cached JWK to verify the signature using your preferred library (for java the standard is jose4j) making sure that:

->> The following critical headers are set: "https://payconiq.com/iat", "https://payconiq.com/jti", "https://payconiq.com/path", "https://payconiq.com/iss", "https://payconiq.com/sub".

- This assumes that the public key certificate has not been cached.

- Extract the "kid" field from the JOSE Header of the signature.

- Download the JWK which matches the key id ("kid") field in the JOSE Header of the signature.

Use the downloaded JWK to verify the signature using your preferred library (for java the standard is jose4j) making sure that:

->> The following critical headers are set: "https://payconiq.com/iat", "https://payconiq.com/jti", "https://payconiq.com/path", "https://payconiq.com/iss", "https://payconiq.com/sub".

It is important to confirm that the signature is valid before processing the callback. This is to ensure that the payment data returned has not been tampered with and has been processed by Payconiq.

The Payconiq Certificates

The certificate is hosted in a JSON Web Key (JWK) format as a JSON Web Key Set (JWKS). They can be found using the following links:

EXT Path to JWK: https://ext.payconiq.com/certificates

PROD Path to JWK: https://payconiq.com/certificates

Rotating Payconiq Certificates

Payconiq reserves the right to rotate the certificates used to generate the callback signature. In view of this, Payconiq recommends programmatically fetching the JWKs and using the values to verify the signature.

Payconiq will follow and below guidelines with regards to hosting and rotating JWKs.

Rotating the JWK Payconiq will append a new JWK with a new kid to the existing JWKs for the first 24 hours. After the 24-hour period, the old JWK will be removed from the host site location.

Merchants and Partners should cache the JWKs for a period of 12 hours and use it to verify any signature sent by Payconiq. After 12 hours, the JWKs must be re-cached automatically. If there any changes made to the JWKs, the changes should come into effect.

Please contact devsupport if the signature verification continues to fail.

Status codes and Errors

The Payconiq API uses conventional HTTP response codes to indicate success or failure of an API request. In general, codes in the 2xx range indicate success, codes in the 4xx range indicate malformed client request (e.g., a required parameter was omitted, a charge failed, etc.) and codes in the 5xx range indicate an error with Payconiq servers. All errors should be handled programatically to prevent applications from breaking.

In the event of an error status code, an error object will be returned as part of the response when the API endpoint is called.

HTTP Codes used by Payconiq

Below are the list of codes Payconiq uses via HTTP responses.

| Status Code | Description |

|---|---|

200 - Ok |

Everything works as expected. |

201 - Created |

Payconiq has successfully fulfilled the request to create a payment. |

204 - No Content |

Payconiq has successfully fulfilled the request to cancel a payment. |

400 - Bad Request |

The request was unacceptable. This usually happens when there are missing parameters. |

401 - Unauthorized |

The API key provided is not valid. |

403 - Forbidden |

The user is not allowed to access the resource requested. |

404 - Not Found |

The requested resource does not exist. |

422 - Unprocessable Entity |

Payconiq cannot process the request due to restrictions. |

429 - Too Many Requests |

This error code is returned when there are too many requests to the Payconiq backend. |

500 - Internal Server Error |

Something went wrong on Payconiq’s end. (This is rare) |

503 - Service Unavailable |

Something went wrong on Payconiq’s end. (This is rare) |

Payment Statuses

Below is the list of statuses that are returned by the Payconiq API.

| Status Name | Status Description |

|---|---|

AUTHORIZED |

This is the status of a payment before it is set to SUCCEEDED. Payconiq internal checks for payment are successful. This occurs before the payment is sent to the bank for processing. |

AUTHORIZATION_FAILED |

This occurs when the bank fails to approve a payment due to validation reasons. These reasons include insufficient funds, limits exceeded, etc. |

CANCELLED |

A payment has been cancelled by a merchant or consumer. If a payment is cancelled, it cannot be scanned and paid. |

EXPIRED |

A payment has exceeded the allowable time to pay. If a payment has expired, it cannot be paid. |

FAILED |

Something has gone wrong while confirming a payment such as incorrect consumer or merchant data setup. |

IDENTIFIED |

A payment has been scanned by a Payconiq supported app and is pending confirmation or cancellation. |

PENDING |

A payment has been created and it has not been scanned. Consumers can scan QR code linked to this payment and confirm it. |

SUCCEEDED |

A payment has been authorized and processed successfully by Payconiq and the consumer's bank. This the final end state of a successful payment. |

PENDING_MERCHANT_ACKNOWLEDGEMENT |

A Payment has been has been confirmed by a consumer and is pending acknowledgment from the partner to either complete or void the payment. Note: This was only supported where Void was enabled for the partner, currently void flow is not supported by Payconiq. |

Errors

The Payconiq API uses conventional HTTP response codes in combination with a JSON body to indicate success or failure of an API request. The body of an error response will contain the following fields.

Error Response Definition

| Attribute | Comment/Format |

|---|---|

code - Text describing the error that has occurred. |

[String, required] UNAUTHORIZED, ACCESS_DENIED, PAYMENT_NOT_FOUND, TECHNICAL_ERROR, CALLER_NOT_ALLOWED_TO_CANCEL, PAYMENT_NOT_FOUND, PAYMENT_NOT_PENDING, PAYMENT_CONFLICT, BODY_MISSING, FIELD_REQUIRED, QR_NO_LONGER_IN_USE, UNABLE_TO_PAY_CREDITOR, TRY_AGAIN_LATER |

message - Text describing the error that has occurred. |

[String, required] |

traceId - The id that is assigned to a single request or job. |

[String, required] |

spanId - The id of work unit where the error occurred. |

[String, required] |

Handling Errors

The Payconiq API libraries send back error statuses for many reasons such as failed charge, invalid parameters, authentication errors, timeouts etcetera. We recommend writing code that gracefully handles all possible API errors.

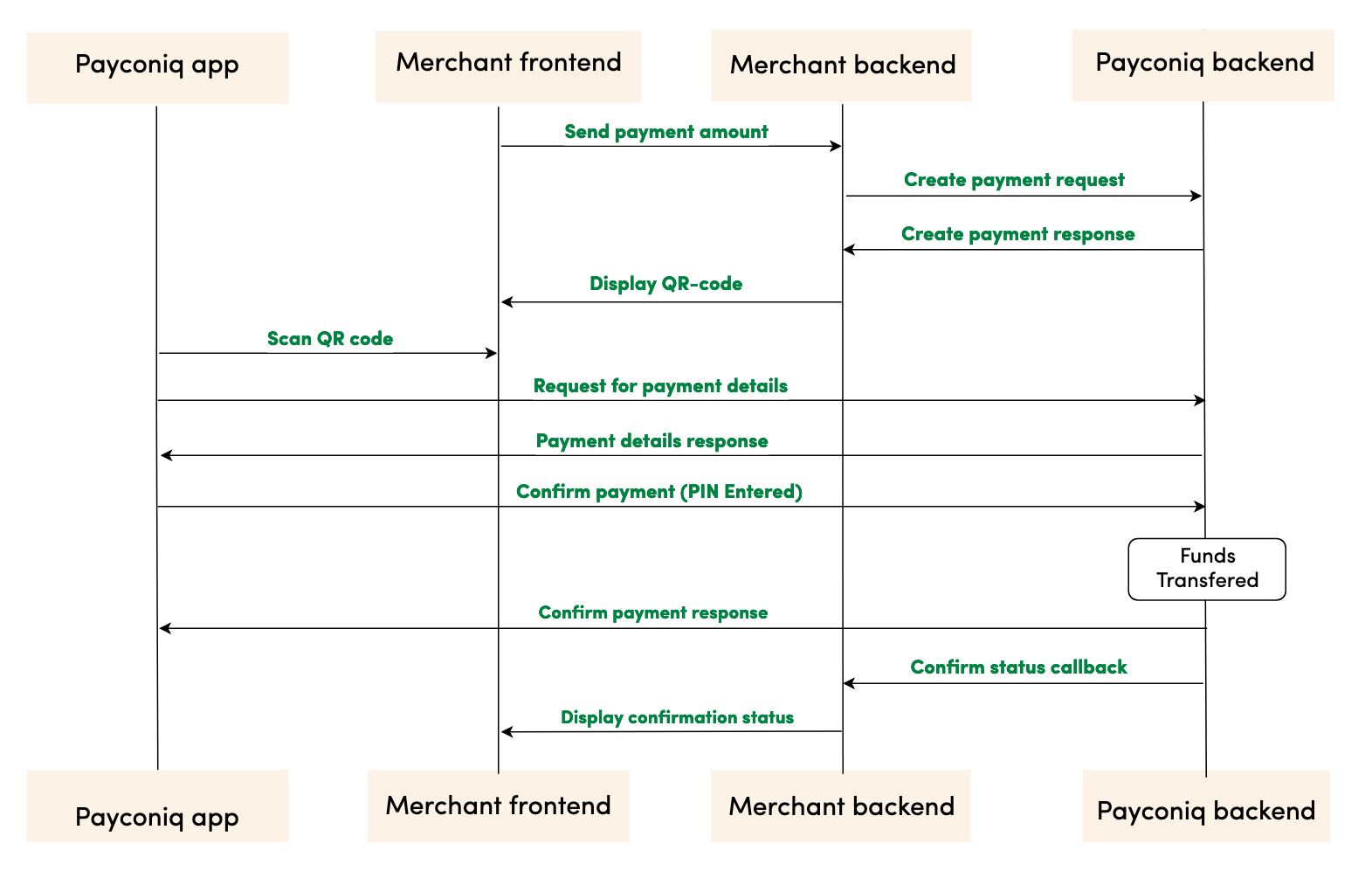

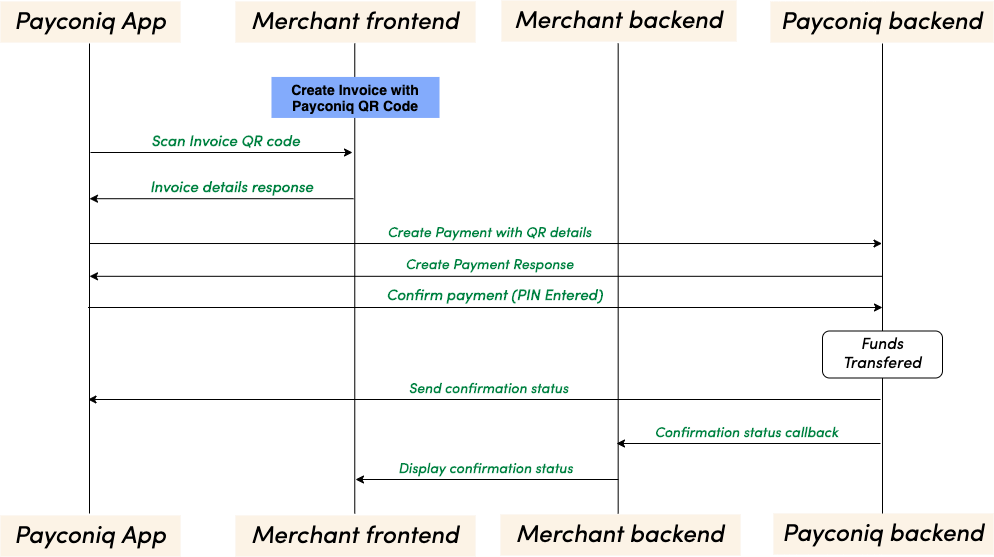

Payconiq Instore (V3) - Display

Pay mobile by scanning the QR code on a customer facing screen and terminal.

Process Flow

Involved Parties:

- Payconiq-supported app – Payconiq consumer application.

- Merchant Frontend – POS terminal or Customer facing display.

- Merchant Backend – Backend of merchant that integrates and interacts with Payconiq.

- Payconiq Backend – Backend of Payconiq that provides integration and payment services.

Step by step payment flow

- Merchant frontend sends payment creation details to Merchant’s backend. This will contain at least the payment amount.

- Merchant backend sends a REST request to the Payconiq backend to create a payment. The parameters passed in this request are the payment amount, payment currency, payment description and other parameters.

- Payconiq backend returns the created payment with the Payconiq payment id and other relevant details to the merchant’s backend – including the QR code.

- The merchant’s backend sends the Payconiq QR url to the merchant frontend to render the payment as a QR code.

- Payconiq-supported app scans the QR code in order to start the payment for the amount displayed. A request for payment details is sent to the Payconiq backend for the payment.

- Payconiq backend sends the payment details to the Payconiq-supported app which would contain the name of the merchant and the amount to pay.

- The consumer confirms the payment by entering his/her PIN, fingerprint or face id and a payment request is sent to the Payconiq Backend for authorization.

- A payment response with the details is sent back to the Payconiq-supported app indicating a success or failure of the payment.

- Payconiq backend sends a payment notification to the Merchant backend with the payment details to the callback url. The details of the notification will either contain success or failure details.

- The merchant frontend displays the confirmation status it receives from Payconiq.

- The consumer is notified of the payment status via the app.

NB: The order of consumer and merchant notification is not sequential. One may arrive before the other depending on internet and network connections.

Prerequisites

- API Key – This is used to secure the request between the merchant’s backend and Payconiq’s backend. Do not share your API keys in public areas such as online sites or client-side code.

- Merchant CallbackUrl (Optional) – This URL will be called by Payconiq’s backend servers in order to send the status of the payment to the merchant.

Please follow the below steps to successfully implement the Payconiq API in your payment terminal or customer facing display.

Create Payment

In order to begin a payment, you need to create a payment via the Payconiq through a POST request. A unique payment identifier is valid for two minutes (120 seconds) after which it expires. If a payment does not take place within these two minutes, a new payment has to be created.

Type: REST

HTTP Verb: POST

EXT URL Definition: https://api.ext.payconiq.com/v3/payments

PROD URL Definition: https://api.payconiq.com/v3/payments

Create Payment Request Header

| Attribute | Comment/ Format |

|---|---|

Authorization [String, required] |

Authorization field which contains the API Key. Bearer xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

Content-type [String, required] application/json |

Content type of the data in the request body. |

Example Request:

curl -X POST

https://api.ext.payconiq.com/v3/payments

-H 'Authorization: Bearer xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx'

-H 'Cache-Control: no-cache'

-H 'Content-Type: application/json'

-d '{

"amount" : "999999",

"currency" : "EUR",

"callbackUrl": "https://dummy.network/api/v1/orders/payconiq",

"description": "Test payment 12345",

"reference": "12345",

"bulkId":"Bulk-1-200"

}'

Create Payment Request Body

| Attribute | Description |

|---|---|

amount [Integer, required] Minimum: 1 Maximum: 999999 |

Payment amount in Euro cents. |

callbackUrl [URI, optional] |

A url to which the Merchant or Partner will be notified of a payment. Must be Https for production. |

currency [String, Optional] |

Payment currency code in ISO 4217 format. Only Euros supported at the moment. Value: EUR |

description[String, optional] Maximum Length: 140 chars |

Custom description of the payment. This will be shown to the consumer when making payments and will be present on the bank statement of the merchant and consumer for reconciliation purposes. Only the first 35 characters are used for the remittance information. |

reference [String, optional] Maximum Length: 35 chars |

External payment reference used to reference the Payconiq payment in the calling party's system. |

bulkId [String, optional] Maximum Length: 35 chars |

A field set to reference a bulk batch payment. |

Example Response:

HTTP/1.1 201 Created

{

"paymentId": "5bdb1685b93d1c000bde96f2",

"status": "PENDING",

"createdAt": "2018-09-18T11:43:29.160Z",

"expiresAt": "2018-09-18T11:43:29.160Z",

"description": "Sample description",

"reference": "987456264",

"amount": 999999,

"currency": "EUR",

"creditor": {

"profileId": "5b71369f5832fd22658e0ef4",

"merchantId": "5b71369f5832fd09188e0915",

"name": "Merchant Name",

"iban": "NL47FRBK0293409698",

"callbackUrl": "https://www.testcallback.com/payconiq/payment"

},

"_links": {

"self": {

"href": "https://api.ext.payconiq.com/v3/payments/5bdb1685b93d1c000bde96f2"

},

"deeplink": {

"href": "https://payconiq.com/pay/2/5bdb1685b93d1c000bde96f2"

},

"qrcode": {

"href": "https://portal.ext.payconiq.com/qrcode?c=https%3A%2F%2Fpayconiq.com%2Fpay%2F2%2F5bdb1685b93d1c000bde96f2"

},

"cancel": {

"href": "https://api.ext.payconiq.com/v3/payments/5bdb1685b93d1c000bde96f2"

}

}

}

Create Payment Response

The following parameters are included in the header and body of the create payment response.

Response Header

| Attribute | Description |

|---|---|

Http Status Code [Integer] |

Status code of the HTTP POST response. 2xx – Indicates success 4xx – Indicates malformed client request 5xx – Indicates errors with Payconiq servers |

Content-type [String] application/json |

Content type of the data |

Response Body

| Attribute | Description |

|---|---|

paymentId [String, required] Fixed length: 24 chars |

The unique Payconiq payment id. |

status [String::enum, required] Allowed values: PENDING |

The status of the Payconiq Payment. |

createdAt [String, required] Format: YYYY-MM-ddTHH:mm:ss.SSSZ |

The creation date and time of the Payconiq payment. |

expiresAt [String, required] Format: YYYY-MM-ddTHH:mm:ss.SSSZ |

The date and time when a Payconiq payment expires. |

description [String, optional] |

Custom description of the payment. This will be shown to the consumer when making payments and will be present on the bank statement of the merchant and consumer for reconciliation purposes. Only the first 35 characters are used for the remmittance information. |

reference [String, optional] |

Merchant’s payment reference used to reference the Payconiq payment in the merchant’s system. |

amount [Integer, required] |

Payment amount in Euro cents. |

currency [String, optional] |

Payment currency code in ISO 4217 format. Only Euros supported at the moment. |

creditor [Object, required] |

The merchant account object set to receive the Payconiq payment from a consumer. |

creditor.profileId [String, required] |

The unique payment product identifier of the merchant. |

creditor.merchantId [String, required] |

The unique identifier of a merchant. |

creditor.name [String, required] |

The merchant’s company name that will be shown to the consumer. |

creditor.iban [String, required] |

The bank account of the merchant where payments will be sent to. |

creditor.callbackUrl [String, optional] |

A URL to which the Merchant or Partner will be notified of a payment. Must be https for production. |

_links [Object, optional] |

Links object which contain urls to be used by merchants to load the QR codes, perform App2App linking, cancel a payment and get the payment details. |

_links.self [Object, optional] |

Hypermedia GET URL used to fetch payment details |

_links.self.href [String :: URI, optional] |

URL String. |

_links.deeplink [Object, optional] |

Hypermedia GET URL used to perform App2App linking |

_links.deeplink.href [String :: URI, optional] |

URL String. |

_links.qrcode [Object, optional] |

Hypermedia GET URL used to fetch QR code for display and scanning purposes (PNG/SVG) |

_links.qrcode.href [String :: URI, optional] |

URL String. |

_links.cancel [Object, optional] |

Hypermedia DELETE URL used to cancel a payment. |

_links.cancel.href [String :: URI, optional] |

URL String. |

HTTP/1.1 400 Bad Request

{

"traceId": "b2586833395d4750",

"spanId": "c235e54376fab4b9",

"code": "FIELD_IS_REQUIRED",

"message": "Field 'amount' is mandatory"

}

Create Payments HTTP Status and Error Codes

Below are the status codes and descriptions returned as part of the API responses.

| Status Code | Error Codes |

|---|---|

400[Integer] |

BODY_MISSING: A JSON body needs to be provided. FIELD_IS_REQUIRED: A mandatory field is missing from the JSON request. FIELD_IS_INVALID: A field provided is not valid. Eg: The length of a field exceeds what is required. |

401 [Integer] |

UNAUTHORIZED: The user not have an API Key or API Key is incorrect. |

403 [Integer] |

ACCESS_DENIED: The API key could not be verified or the API key does not contain the required authority to access the resource requested. |

404 [Integer] |

MERCHANT_PROFILE_NOT_FOUND: The merchant profile for creating a payment does not exist. |

422 [Integer] |

UNABLE_TO_PAY_CREDITOR: This could be returned for multiple reasons in case something goes wrong. |

429 [Integer] |

Too Many Requests |

500 [Integer] |

TECHNICAL_ERROR: Technical error in the Payconiq payment service. |

503 [Integer] |

Service Unavailable |

The Payconiq QR Code

The QR Code can be displayed using the following method.

The Payconiq QR code can be rendered in a web view container for quick scanning. A parameter with name _links.qrcode.href returns a link that can be easily rendered in a web view. This url makes use of Payconiq’s QR code generation service. By default, the Payconiq QR code is returned as a PNG, small (S) size and magenta in color.

| Attribute | Description |

|---|---|

f [String :: Enum] Allowed Values: SVG, PNG |

Image format |

s [String :: Enum] Allowed Values: S, M, L, XL |

Image size of the QR code to generate. Small (S) = 180x180 Medium (M) = 250x250 Large (L) = 400x400 Extra Large (XL) = 800x800 The sizes only applies to PNG format. |

cl [String :: Enum] Allowed Values: magenta, black |

The colour of the QR code. Default is magenta. |

Sample formatted URL

Size: (L) Large

Image Format: PNG

Formatted Url: https://portal.payconiq.com/qrcode?c=https://payconiq.com/pay/1/5c1b589a296e9a3330aebbe0&s=L&f=PNG

Sample QR Code Image

Payconiq QR Code Sizes and Scan Distances.

- Payconiq recommends the following Payconiq QR Code sizes and scanning distances when displaying the Payconiq QR Code.

- Take note of the scanning distance in order to use the correct Payconiq QR Code size.

| Recommended Size | Pixels | Scanning Distance |

|---|---|---|

| Small (S) | 180x180 pixels | 15 cm |

| Medium (M) | 250x250 pixels | 20 cm |

| Large (L) | 400x400 pixels | 30 cm |

| Extra Large (XL) | 800x800 pixels | 40 cm |

Note:

- If the resolution is lower than the screen resolution please use the SVG instead of the PNG to keep a sharp image.

- In case any of these sizes are not compatible with your setup please get in touch via [email protected] for further assistance.

The Payconiq Callback

Payconiq calls the merchant’s callbackUrl endpoint to send the status of a payment. This is only informational towards the merchant or partner. There is no impact on a payment if it is not processed successfully by the merchant or partner.

The merchant backend must verify that the notification message originated from Payconiq and was not altered or corrupted during transmission by validating the signature.

Type: REST

HTTP Verb: POST

EXT URL Definition: {callbackUrl}

PROD URL Definition: {callbackUrl}

Callback Request Header

The following parameters are included in the header of the callback request.

signature: eyJ0eXAiOiJKT1NFK0pTT04iLCJraWQiOiJ5ZXNPbmUiLCJhbGciOiJSUzI1NiIsImh0dHBzOi8vcGF5Y29uaXEuY29tL2lhdCI6IjIwMTktMDEtMTRUMTE6MTE6MTFaIiwiaHR0cHM6Ly9wYXljb25pcS5jb20vanRpIjoiR2l2ZU1lIiwiaHR0cHM6Ly9wYXljb25pcS5jb20vcGF0aCI6Ii90aGUvcm9hZC9sZXNzL3RyYXZlbGVkIiwiaHR0cHM6Ly9wYXljb25pcS5jb20vaXNzIjoiUGF5Y29uaXEiLCJjcml0IjpbImh0dHBzOi8vcGF5Y29uaXEuY29tL2lhdCIsImh0dHBzOi8vcGF5Y29uaXEuY29tL2p0aSIsImh0dHBzOi8vcGF5Y29uaXEuY29tL3BhdGgiLCJodHRwczovL3BheWNvbmlxLmNvbS9pc3MiXX0..LoBPG9T00c-0urv5FXrTWmumUJBTpTaqG5F0HciYHgi0Ck-bZrFxX8MLEgKbdv5YUMKKDnbLcFS0M4lNiGa17Qo8OOH4mCAjvuVEyoutHObd_TrZ4oUM0CX3uRNd88shemup9YPEMtRjmPZATXzStTBdQeRpq_f89bAqy2nCOxg_2BgqSnvC_R4JMA7I5SaRndvzbn80oeVHUEMkpmRFNnhRtVujeEUnfn3hBR_YIHh3vJKWArIYOV9eMkpDFb6nC_GoZoNGfPFunBUtOXU1y3gCDi6GOsa4eaDygNsBk-ZNj2v8cMRPBnHdw2oOaAjEs6K63An0bbkdKG7UzVojAw

content-type: application/json

user-agent: Payconiq Payments/v3

| Attribute | Comment/ Format |

|---|---|

signature [String, required] |

This represents a Payconiq digitally signed content using JSON data structures and base64url encoding. The signature is made up of JSON Web Signature (JWS) and a JSON Object Signing and Encryption (JOSE) header. |

content-type [String, required] application/json |

The Content-Type entity header is used to indicate the media type of the resource. |

user-agent [String, required] |

The User-Agent request header contains a characteristic string that allows the network protocol peers to identify the application type, operating system, software vendor or software version of the requesting software user agent. |

{

"paymentId": "5ba37c3d0989e3000758b9d8",

"transferAmount": 122,

"tippingAmount": 0,

"amount": 122,

"totalAmount": 122,

"description": "Sample description",

"createdAt": "2019-11-26T15:26:19.363Z",

"expireAt": "2019-11-26T15:29:19.363Z",

"succeededAt": "2019-11-26T15:27:34.835Z",

"status": "SUCCEEDED",

"debtor": {

"name": "John",

"iban": "*************12636"

},

"currency": "EUR",

"reference": "12346816AFV"

}

Callback Request Body

The following parameters are included in the body of the callback request.

| Attribute | Description |

|---|---|

paymentId [String, required] Fixed length: 24 chars |

The unique Payconiq payment id. |

amount [Integer, required] Minimum: 1 Maximum: 999999 |

Payment amount in Euro cents. |

transferAmount [Integer, required] Minimum: 1 Maximum: 999999 |

The amount the consumer will be charged in Euro cents |

tippingAmount [Integer, required] Minimum: 1 Maximum: 999999 |

The amount added as a tip by the consumer in Euro cents (currently not supported). |

totalAmount [Integer, required] Minimum: 1 Maximum: 999999 |

The amount the consumer pays in total in Euro cents. |

currency [String, optional] |

Payment currency code in ISO 4217 format. Only Euros supported at the moment. |

description [String, optional] |

Custom description of the payment. This will be shown to the consumer when making payments and will be present on the bank statement of the merchant and consumer for reconciliation purposes. Only the first 35 characters are used for the remittance information. |

reference [String, optional] |

Merchant’s payment reference used to reference the Payconiq payment in the merchant’s system. |

createdAt [String, required] Format: YYYY-MM-ddTHH:mm:ss.SSSZ |

The creation date and time of the Payconiq payment. |

expireAt [String, required] Format: YYYY-MM-ddTHH:mm:ss.SSSZ |

The date and time when a Payconiq payment expires. |

succeededAt [String, optional] Format: YYYY-MM-ddTHH:mm:ss.SSSZ |

The date and time when a Payconiq payment succeeded. |

status [String::enum, required] Allowed values: PENDING, IDENTIFIED, AUTHORIZED, AUTHORIZATION_FAILED, SUCCEEDED, FAILED, CANCELLED, EXPIRED, PENDING_MERCHANT_ACKNOWLEDGEMENT. |

The status of the Payconiq Payment. |

debtor[JSON Object, required] |

The consumer account object that makes payments to the merchant |

debtor.name [String, optional] |

Debtor's first name. |

debtor.iban [String, optional] |

Debtor's IBAN masked. |

Callback Not Received or Signature Validation Fails

In the event where you don't receive the callback or the callback validation fails, you should Get the Transaction Details as described below. Getting the details of a payment is another sure way to know the status in order to complete the payment.

Get Payment Details

Payment details of an existing payment may be obtained. A unique payment id is passed from a payment creation request and Payconiq will return the corresponding payment information.

Note: It is recommended to implement this as a fallback option to obtaining the response via the callback URL.

Type: REST

HTTP Verb: GET

EXT URL Definition: https://api.ext.payconiq.com/v3/payments/{paymentId}

PROD URL Definition: https://api.payconiq.com/v3/payments/{paymentId}

Get Payment Details Header

The following parameters are included in the header of the request.

| Attribute | Comment/ Format |

|---|---|

Authorization [String, required] |

Authorization field which contains the API Key. Bearer xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

Content-type [String, required] application/json |

Content type of the data in the request body. |

Example Request:

curl -X GET

https://api.ext.payconiq.com/v3/payments/5b976d11dd172a0007c4429d

-H 'Authorization: Bearer xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx'

-H 'Content-Type: application/json'

Get Payment Details Request Path

The following parameters are included in the path of a get payment details request.

| Attribute | Description |

|---|---|

paymentId [String, required] |

The unique Payconiq identifier of a payment as provided by the create payment service. |

Get Payment Details Response Header

The following parameters are included in the header of the get payment details response.

| Attribute | Description |

|---|---|

Http Status Code [Integer] |

Status code of the HTTP POST response. 2xx – Indicates success 4xx – Indicates malformed client request 5xx – Indicates errors with Payconiq servers |

Content-type [String] application/json |

Content type of the data |

Example Response

HTTP/1.1 200 OK

Content-Type: application/json

{

"paymentId": "5bdaf066b93d1c000bde9683",

"createdAt": "2019-11-26T15:26:19.363Z",

"expireAt": "2019-11-26T15:29:19.363Z",

"succeededAt": "2019-11-26T15:27:34.835Z",

"currency": "EUR",

"status": "SUCCEEDED",

"creditor": {

"profileId": "5b71369f5832fd22658e0ef4",

"merchantId": "5b71369f5832fd09188e0915",

"name": "Merchant Name",

"iban": "NL47FRBK0293409698",

"callbackUrl": "https://www.testcallback.com/payconiq/payment"

},

"debtor": {

"name": "John",

"iban": "*************12636"

},

"amount": 10,

"transferAmount": 10,

"tippingAmount": 0,

"totalAmount": 10,

"description": "Otto's Payment Test",

"bulkId": "centraal station pos-2",

"_links": {

"self": {

"href": "https://api.ext.payconiq.com/v3/payments/5bdaf066b93d1c000bde9683"

},

"deeplink": {

"href": "https://payconiq.com/pay/2/5bdaf066b93d1c000bde9683"

},

"qrcode": {

"href": "https://portal.ext.payconiq.com/qrcode?c=https%3A%2F%2Fpayconiq.com%2Fpay%2F2%2F5bdaf066b93d1c000bde9683"

},

"refund": {

"href": "https://api.ext.payconiq.com/v3/payments/5bdaf066b93d1c000bde9683/debtor/refundIban"

}

}

}

Get Payment Details Response Body

The following parameters are included in the body of the get payment details response.

| Attribute | Description |

|---|---|

paymentId [String, required] Fixed length: 24 chars |

The unique Payconiq payment id. |

createdAt [String, required] Format: YYYY-MM-ddTHH:mm:ss.SSSZ |

The creation date and time of the Payconiq payment. |

expireAt [String, required] Format: YYYY-MM-ddTHH:mm:ss.SSSZ |

The date and time when a Payconiq payment expires. |

succeededAt [String, optional] Format: YYYY-MM-ddTHH:mm:ss.SSSZ |

The date and time when a Payconiq payment succeeded. |

currency [String, required] |

Payment currency code in ISO 4217 format. Only Euros supported at the moment. |

status [String::enum, required] Allowed values: PENDING, IDENTIFIED, CANCELLED, AUTHORIZED, AUTHORIZATION_FAILED, EXPIRED, FAILED, SUCCEEDED, PENDING_MERCHANT_ACKNOWLEDGEMENT |

The status of the Payconiq Payment. |

creditor [JSON Object, required] |

The merchant account object set to receive the Payconiq payment from a consumer. |

creditor.profileId [String, required] |

The unique payment product identifier of the merchant. |

creditor.merchantId [String, required] |

The unique identifier of a merchant. |

creditor.name [String, required] |

The merchant’s company name that will be shown to the consumer. |

creditor.iban [String, required] |

The bank account of the merchant where payments will be sent to. |

creditor.callbackUrl [String, optional] |

A URL to which the Merchant or Partner will be notified of a payment. Must be https for production. |

debtor[JSON Object, optional] |

The consumer account object that makes payments to the merchant |

debtor.name [String, optional] |

First name of Debtor. |

debtor.iban [String, optional] |

IBAN of Debtor masked. |

amount [Integer, required] |

Payment amount in Euro cents. |

transferAmount [Integer, required] Minimum: 1 Maximum: 999999 |

The amount the consumer will be charged in Euro cents |

tippingAmount [Integer, required] Minimum: 1 Maximum: 999999 |

The amount added as a tip by the consumer in Euro cents (currently not supported). |

totalAmount [Integer, required] Minimum: 1 Maximum: 999999 |

The amount the consumer pays in total in Euro cents. |

description [String, optional] |

Custom description of the payment. This will be shown to the consumer when making payments and will be present on the bank statement of the merchant and consumer for reconciliation purposes. Only the first 35 characters are used for the remittance information. |

message [String, optional] |

Custom message from the consumer. |

reference [String, optional] |

Merchant’s payment reference used to reference the Payconiq payment in the merchant’s system. |

bulkId [String, optional] Maximum Length: 35 chars |

A field set to reference a bulk batch payment. |

_links [Object, optional] |

Links object which contain urls to be used by merchants to load the QR codes, perform App2App linking, cancel a payment and get the payment details. |

_links.self [Object, optional] |

Hypermedia GET URL used to fetch payment details |

_links.self.href [String :: URI, optional] |

URL String. |

_links.deeplink [Object, optional] |

Hypermedia GET URL used to perform App2App linking |

_links.deeplink.href [String :: URI, optional] |

URL String. |

_links.qrcode [Object, optional] |

Hypermedia GET URL used to fetch QR code for display and scanning purposes (PNG/SVG) |

_links.qrcode.href [String :: URI, optional] |

URL String. |

_links.cancel [Object, optional] |

Hypermedia DELETE URL used to cancel a payment. |

_links.cancel.href [String :: URI, optional] |

URL String. |

_links.refund [Object, optional] |

Hypermedia GET Url used to fetch refund information for a payment. |

_links.refund.href [String :: URI, optional] |

URL String. |

HTTP/1.1 404 Not Found

{

"traceId": "d7152b6b08caa620",

"spanId": "556d68164b8e8ef6",

"code": "PAYMENT_NOT_FOUND",

"message": "Payment not found '5ba35a3d0989e3000758b9c2'"

}

Get Payment Details HTTP Status and Error Codes

Below are the status codes and descriptions returned as part of the API responses.

| Status Code | Error Codes |

|---|---|

401 [Integer] |

UNAUTHORIZED: The user not have an API Key or API Key is incorrect. |

403 [Integer] |

ACCESS_DENIED: The API key could not be verified or the API key does not contain the required authority to access the resource requested. |

404 [Integer] |

PAYMENT_NOT_FOUND: Payment could not be found for the corresponding payment id. |

429 [Integer] |

Too Many Requests |

500 [Integer] |

TECHNICAL_ERROR: Technical error in the Payconiq payment service. |

503 [Integer] |

Service Unavailable |

Get Payments List

This endpoint is use to retrieve a list of a Payconiq payments. The page and size parameters are used to specify how many records to return as well as filter the results for the total number of records returned per page. By default the latest 50 payments are returned per request and are sorted by creation date in descending order.

Type: REST

HTTP Verb: POST

EXT URL Definition: https://api.ext.payconiq.com/v3/payments/search?page={p}&size={s}

PROD URL Definition: https://api.payconiq.com/v3/payments/search?page={p}&size={s}

Get Payments List Request Header

| Attribute | Comment/ Format |

|---|---|

Authorization [String, required] |

Authorization field which contains the API Key. Bearer xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

Content-type [String, required] application/json |

Content type of the data in the request body. |

Example Request:

curl -X POST

'https://api.ext.payconiq.com/v3/payments/search?page=10&size=10'

-H 'Authorization: Bearer xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx'

-H 'Cache-Control: no-cache'

-H 'Content-Type: application/json'

-d

'{

"from":"2018-08-01T00:10:10.000Z",

"to":"2018-08-31T00:10:10.999Z",

"paymentStatuses":["SUCCEEDED"],

"reference":"1234568"

}'

Get Payments List Request Path

| Attribute | Comment/ Format |

|---|---|

page [Integer, optional] |

Zero based page index in the list request. NB: The page defaults to 0 if not present in the request path. |

size [Integer, optional] |

The size of the page to be returned in the list. NB: The size defaults to 50 if not present in the request path. |

Get Payments List Request Body

| Attribute | Description |

|---|---|

from [String, required] Format: YYYY-MM-ddTHH:mm:ss.SSSZ |

The start date and time to filter the search results. Default: Current date and time minus one day. (Now - 1 day) |

to [String, optional] Format: YYYY-MM-ddTHH:mm:ss.SSSZ |

The end date and time to filter the search results.. Default: Current date and time. (Now) |

paymentStatuses [Array::String, Optional] |

An array of payment statuses to filter the search results on. |

reference [String, optional] Maximum Length: 35 chars |

External payment reference used to reference the Payconiq payment in the calling party's system. |

Get Payment List Response Header

The following parameters are included in the header of the get payment list response.

| Attribute | Description |

|---|---|

Http Status Code [Integer] |

Status code of the HTTP POST response. 2xx – Indicates success 4xx – Indicates malformed client request 5xx – Indicates errors with Payconiq servers |

Content-type [String] application/json |

Content type of the data |

HTTP/1.1 200 OK

{

"size": 2,

"totalPages": 7,

"totalElements": 13,

"number": 0,

"details": [

{

"paymentId": "5bdaf066b93d1c000bde9683",

"createdAt": "2019-11-26T15:26:19.363Z",

"expireAt": "2019-11-26T15:29:19.363Z",

"succeededAt": "2019-11-26T15:27:34.835Z",

"currency": "EUR",

"status": "SUCCEEDED",

"creditor": {

"profileId": "5b71369f5832fd22658e0ef4",

"merchantId": "5b71369f5832fd09188e0915",

"name": "Merchant Name",

"iban": "NL47FRBK0293409698",

"callbackUrl": "https://www.testcallback.com/payconiq/payment"

},

"debtor": {

"name": "John",

"iban": "*************12636"

},

"amount": 10,

"transferAmount": 10,

"tippingAmount": 0,

"totalAmount": 10,

"description": "Otto's Payment Test",

"bulkId": "centraal station pos-2",

"_links": {

"self": {

"href": "https://api.ext.payconiq.com/v3/payments/5bdaf066b93d1c000bde9683"

},

"deeplink": {

"href": "https://payconiq.com/pay/2/5bdaf066b93d1c000bde9683"

},

"qrcode": {

"href": "https://portal.ext.payconiq.com/qrcode?c=https%3A%2F%2Fpayconiq.com%2Fpay%2F2%2F5bdaf066b93d1c000bde9683"

},

"refund": {

"href": "https://api.ext.payconiq.com/v3/payments/5bdaf066b93d1c000bde9683/debtor/refundIban"

}

}

},

{

"paymentId": "5bdaf066b93d1c000bde9683",

"createdAt": "2019-11-26T15:26:19.363Z",

"expireAt": "2019-11-26T15:29:19.363Z",

"succeededAt": "2019-11-26T15:27:34.835Z",

"currency": "EUR",

"status": "SUCCEEDED",

"creditor": {

"profileId": "5b71369f5832fd22658e0ef4",

"merchantId": "5b71369f5832fd09188e0915",

"name": "Merchant Name",

"iban": "NL47FRBK0293409698",

"callbackUrl": "https://www.testcallback.com/payconiq/payment"

},

"debtor": {

"name": "John",

"iban": "*************12636"

},

"amount": 10,

"transferAmount": 10,

"tippingAmount": 0,

"totalAmount": 10,

"description": "Otto's Payment Test",

"bulkId": "centraal station pos-2",

"_links": {

"self": {

"href": "https://api.ext.payconiq.com/v3/payments/5bdaf066b93d1c000bde9683"

},

"deeplink": {

"href": "https://payconiq.com/pay/2/5bdaf066b93d1c000bde9683"

},

"qrcode": {

"href": "https://portal.ext.payconiq.com/qrcode?c=https%3A%2F%2Fpayconiq.com%2Fpay%2F2%2F5bdaf066b93d1c000bde9683"

},

"refund": {

"href": "https://api.ext.payconiq.com/v3/payments/5bdaf066b93d1c000bde9683/debtor/refundIban"

}

}

}

]

}

Get Payments list Response Body

The following parameters are included in the body of the get payment details response.

| Attribute | Description |

|---|---|

size [Integer, required] |

The total size of elements returned in the current page. |

totalPages [Integer, required] |

Total number of pages that contain the list of results. |

totalElements [Integer, required] |

Total number of elements in the list requested. |

number [Integer, required] |

The current page number. |

details [JSON Object, required] |

An array of payment details returned for the search criteria. |

details.paymentId [String, required] Fixed length: 24 chars |

The unique Payconiq payment id. |

details.createdAt [String, required] Format: YYYY-MM-ddTHH:mm:ss.SSSZ |

The creation date and time of the Payconiq payment. |

details.expireAt [String, required] Format: YYYY-MM-ddTHH:mm:ss.SSSZ |

The date and time when a Payconiq payment expires. |

details.succeededAt [String, optional] Format: YYYY-MM-ddTHH:mm:ss.SSSZ |

The date and time when a Payconiq payment succeeded. |

details.currency [String, required] |

Payment currency code in ISO 4217 format. Only Euros supported at the moment. |

details.status [String::enum, required] Allowed values: PENDING, IDENTIFIED, CANCELLED, AUTHORIZED, AUTHORIZATION_FAILED, EXPIRED, FAILED, SUCCEEDED, PENDING_MERCHANT_ACKNOWLEDGEMENT |

The status of the Payconiq Payment. |

details.creditor [JSON Object, required] |

The merchant account object set to receive the Payconiq payment from a consumer. |

details.creditor.profileId [String, required] |

The unique payment product identifier of the merchant. |

details.creditor.merchantId [String, required] |

The unique identifier of a merchant. |

details.creditor.name [String, required] |

The merchant’s company name that will be shown to the consumer. |

details.creditor.iban [String, required] |

The bank account of the merchant where payments will be sent to. |

details.creditor.callbackUrl [String, optional] |

A URL to which the Merchant or Partner will be notified of a payment. Must be https for production. |

details.debtor[JSON Object, required] |

The consumer account object that makes payments to the merchant |

details.debtor.name [String, optional] |

First name of Debtor. |

details.debtor.iban [String, optional] |

IBAN of Debtor masked. |

details.amount [Integer, required] |

Payment amount in Euro cents. |

details.transferAmount [Integer, required] Minimum: 1 Maximum: 999999 |

The amount the consumer will be charged in Euro cents |

details.tippingAmount [Integer, required] Minimum: 1 Maximum: 999999 |

The amount added as a tip by the consumer in Euro cents (currently not supported). |

details.totalAmount [Integer, required] Minimum: 1 Maximum: 999999 |

The amount the consumer pays in total in Euro cents. |

details.description [String, optional] |

Custom description of the payment. This will be shown to the consumer when making payments and will be present on the bank statement of the merchant and consumer for reconciliation purposes. Only the first 35 characters are used for the remittance information. |

details.message [String, optional] |

Custom message from the consumer. |

details.reference [String, optional] |

Merchant’s payment reference used to reference the Payconiq payment in the merchant’s system. |

details.bulkId [String, optional] Maximum Length: 35 chars |

A field set to reference a bulk batch payment. |

details._links [Object, optional] |

Links object which contain urls to be used by merchants to load the QR codes, perform App2App linking, cancel a payment and get the payment details. |

details._links.self [Object, optional] |

Hypermedia GET URL used to fetch payment details |

details._links.self.href [String :: URI, optional] |

URL String. |

details._links.deeplink [Object, optional] |

Hypermedia GET URL used to perform App2App linking |

details._links.deeplink.href [String :: URI, optional] |

URL String. |

details._links.qrcode [Object, optional] |

Hypermedia GET URL used to fetch QR code for display and scanning purposes (PNG/SVG) |

details._links.qrcode.href [String :: URI, optional] |

URL String. |

details._links.cancel [Object, optional] |

Hypermedia DELETE URL used to cancel a payment. |

details._links.cancel.href [String :: URI, optional] |

URL String. |

details._links.refund [Object, optional] |

Hypermedia GET Url used to fetch refund information for a payment. |

details._links.refund.href [String :: URI, optional] |

URL String. |

HTTP/1.1 401 Unauthorized

{

"traceId": "d7152b6b08caa620",

"spanId": "556d68164b8e8ef6",

"code": "UNAUTHORIZED",

"message": "Payment not found '5ba35a3d0989e3000758b9c2'"

}

Get Payments List HTTP Status and Error Codes

| Status Code | Error Codes |

|---|---|

401 [Integer] |

UNAUTHORIZED: The user not have an API Key or API Key is incorrect. |

403 [Integer] |

ACCESS_DENIED: The API key could not be verified or the API key does not contain the required authority to access the resource requested. |

429 [Integer] |

Too Many Requests |

500 [Integer] |

TECHNICAL_ERROR: Technical error in the Payconiq payment service. |

503 [Integer] |

Service Unavailable |

Cancel Payment

This endpoint is used to cancel a created Payment. A payment can only be cancelled only if the status is either PENDING or IDENTIFIED. For some cases when payment is still in IDENTIFIED cancellation is not possible because a customer has already initiated payment confirmation. Once confirmation is complete, the payment will be moved to SUCCEEDED. Once cancelled, the status of the payment is set to CANCELLED.

Type: REST

HTTP Verb: DELETE

EXT URL Definition: https://api.ext.payconiq.com/v3/payments/{paymentId}

PROD URL Definition: https://api.payconiq.com/v3/payments/{paymentId}

Cancel Payment Request Header

| Attribute | Comment/ Format |

|---|---|

Authorization [String, required] |

Authorization field which contains the API Key. Bearer xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

Example Request:

curl -X DELETE

https://api.ext.payconiq.com/v3/payments/5ba35a3d0989e3000758b9c1

-H 'Authorization: Bearer xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx'

Cancel Payment Request Path

| Attribute | Comment/ Format |

|---|---|

paymentId [Integer, required] Fixed length: 24 chars |

The unique identifier of a payment as provided by the create payment service. |

Cancel Payment Request Body

There is no body in cancel payment request.

Cancel Payment Response Header

HTTP/1.1 204 No Content

The following parameters are included in the header of the cancel payment response.

| Attribute | Description |

|---|---|

Http Status Code [Integer] |

Status code of the HTTP POST response. 2xx – Indicates success 4xx – Indicates malformed client request 5xx – Indicates errors with Payconiq servers |

Content-type [String] application/json |

Content type of the data |

Cancel Payment Response Body

There is no body returned in the body of a cancel payment response.

HTTP/1.1 422 Unprocessable Entity

{

"traceId": "8abc6e29041adb94",

"spanId": "6ba82033652b5b41",

"code": "PAYMENT_NOT_PENDING",

"message": "Payment '5ba35d610989e3000758b9cc' is not allowed to be cancelled"

}

Cancel Payment HTTP Status and Error Codes

| Status Code | Error Codes |

|---|---|

401 [Integer] |

UNAUTHORIZED: The user not have an API Key or API Key is incorrect. |

403 [Integer] |

ACCESS_DENIED: The API key could not be verified or the API key does not contain the required authority to access the resource requested. CALLER_NOT_ALLOWED_TO_CANCEL: The merchant is not allowed to cancel this payment. |

404 [Integer] |

PAYMENT_NOT_FOUND: Payment could not be found for the corresponding payment id. |

422 [Integer] |

PAYMENT_NOT_PENDING: Payment is not in a pending or identify state. |

429 [Integer] |

Too Many Requests |

500 [Integer] |

TECHNICAL_ERROR: Technical error in the Payconiq payment service. |

503 [Integer] |

Service Unavailable |

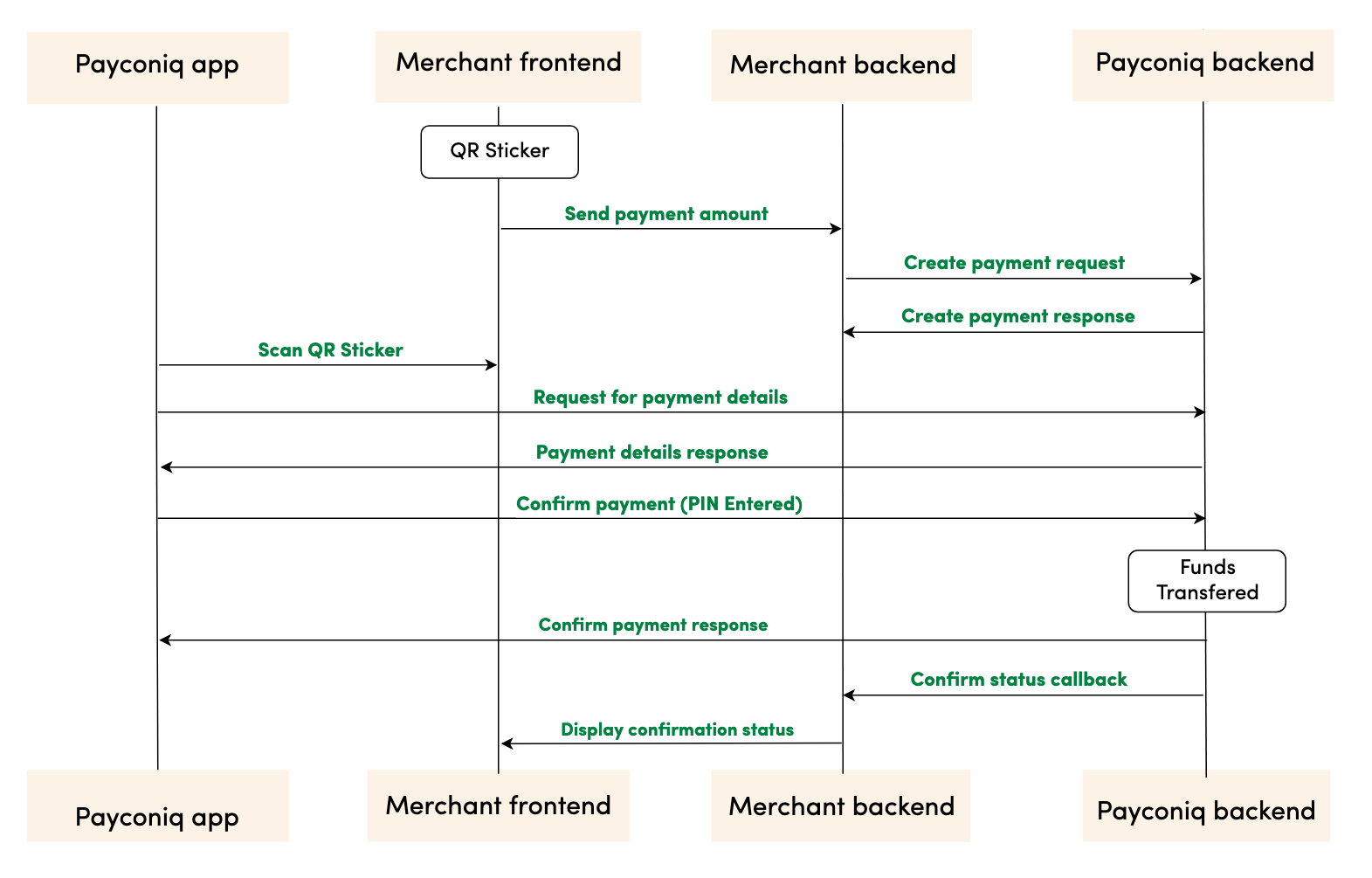

Payconiq Instore (V3) - Static QR Sticker

Pay mobile by scanning the QR code on a sticker. The sticker is integrated with the register.

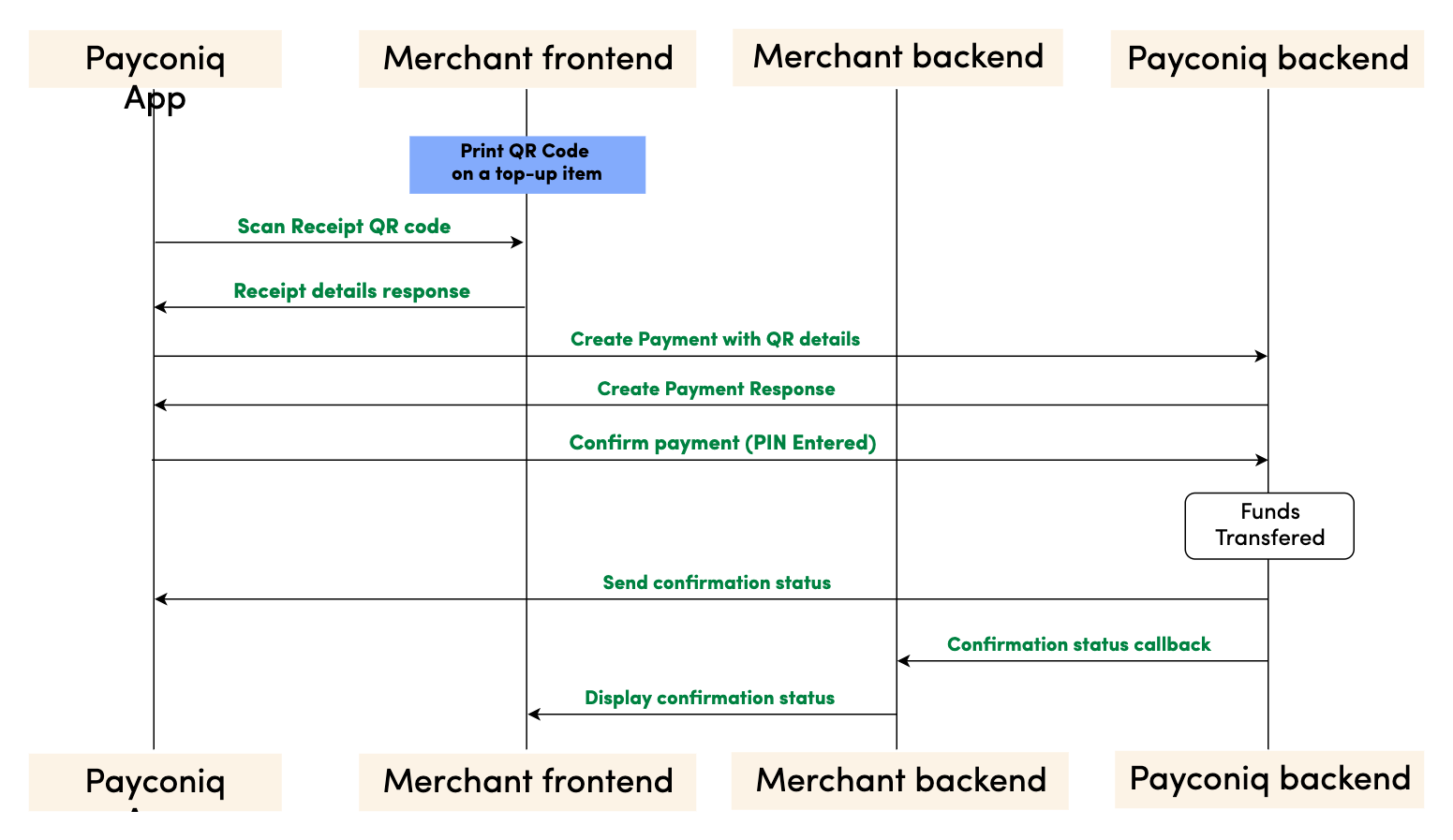

Process Flow

Involved Parties:

- Payconiq-supported app – Payconiq consumer application.

- Merchant Frontend – Point of Sale.

- Merchant Backend – Backend of merchant that integrates and interacts with Payconiq.

- Payconiq Backend – Backend of Payconiq that provides integration and payment services.

Step by step payment flow

- The Merchant displays the Payconiq QR sticker in a location close to the point of sale.

The Merchant creates a Payment by sending a REST request to the Payconiq backend. The request contains the specific POS identifier for which the payment is created.

Payconiq backend returns the created payment with the Payconiq payment id and other relevant details to the merchant’s backend.

- Payconiq-supported app scans the QR sticker to start the payment for the amount to be paid.

- A request for payment details is sent to the Payconiq backend for the payment. The POS ID on the QR is matched with POS ID at the Payconiq backend to fetch the details.

- Payconiq backend sends the payment details for the specific POS ID to the Payconiq-supported app which contains the name of the merchant and the amount to pay.

- The consumer confirms the payment by entering his/her PIN, fingerprint or face id and a payment request is sent to the Payconiq Backend for authorization.

- The consumer is notified of the payment status via the app.

- Payconiq backend sends a payment notification to the Merchant backend with the payment details to the callback url. The details of the notification will either contain success or failure details.

- The merchant frontend displays the confirmation status it receives from Payconiq.

NB: The order of consumer and merchant notification is not sequential. One may arrive before the other depending on internet and network connections.

Prerequisites

- API Key – This is used to secure the request between the merchant’s backend and Payconiq’s backend. Do not share your API keys in public areas such as online sites or client-side code.

- Merchant CallbackUrl (Optional) – This URL will be called by Payconiq’s backend servers in order to send the status of the payment to the merchant.

Please follow the below steps to successfully implement the Payconiq API in your payment terminal or customer facing display.

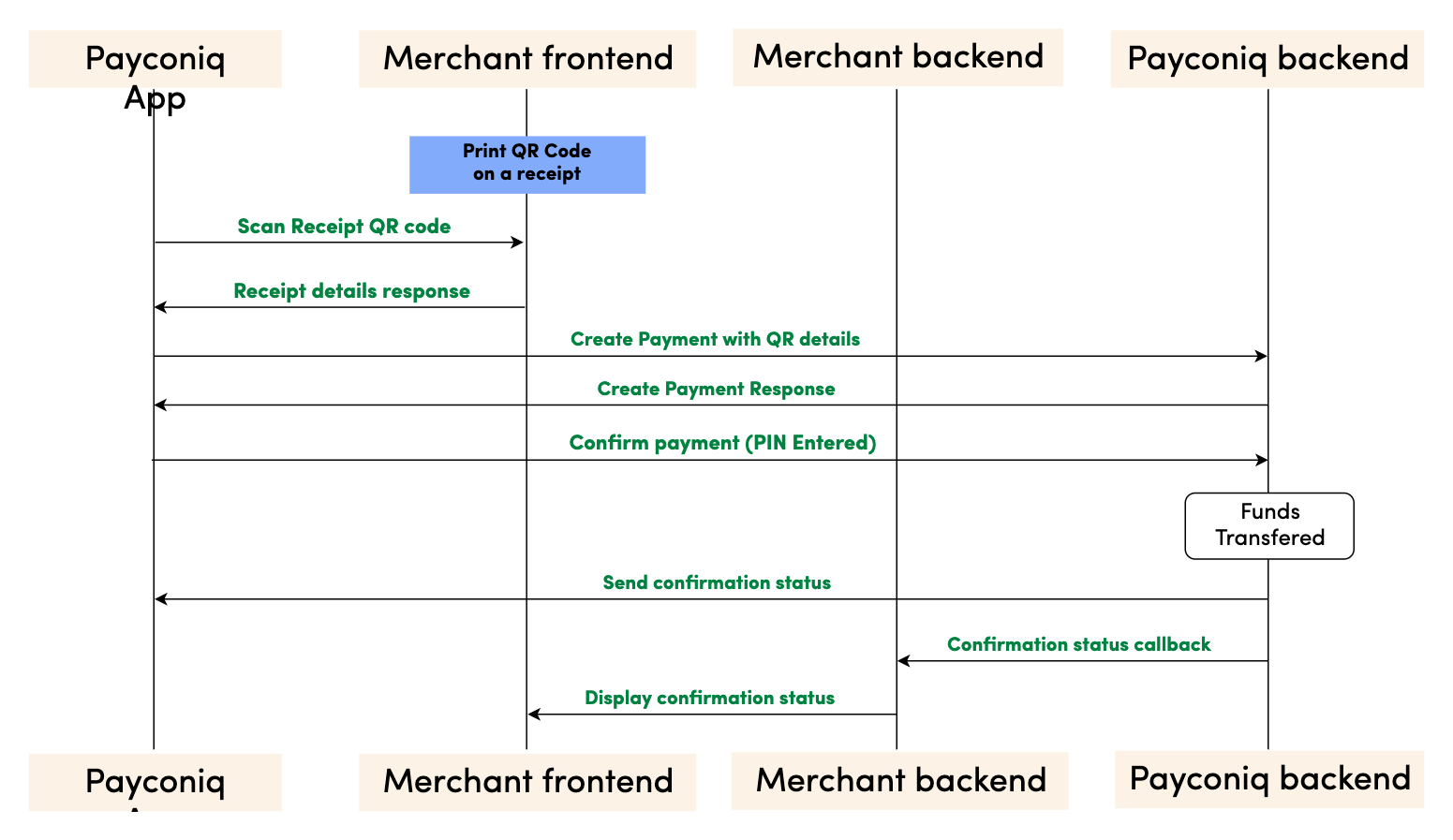

Creating The Payconiq Static QR Code

The Payconiq QR code can be created using the Payconiq QR generation service. The following instructions have to be followed in order to successfully create the QR. Once created, the QR code can be printed on a receipt or top-up medium.

QR Parameters

| Attribute | Description |

|---|---|

f [String :: Enum] Allowed Values: SVG, PNG |

Image format. If not provided, the default format is PNG. |

s [String :: Enum] Allowed Values: S, M, L, XL |

Image size of the QR code to generate. Small (S) = 180x180 Medium (M) = 250x250 Large (L) = 400x400 Extra Large (XL) = 800x800 The sizes only applies to PNG format. *If not provided, the default size is Small. |

c [String, required] |

The Payconiq UTF-8 URL encoded content. This is comprised of the location URL scheme. |

cl [String :: Enum] Allowed Values: magenta, black |

The colour of the QR code. Default is magenta. |

NB: The following link provides a tool to encode the URL as an example: https://www.urlencoder.org/

Generating the QR Code

| Activity | Comment |

|---|---|